Domestic Economy

Prospects for growth in petroleum production in the United States are particularly strong due to increases in tight oil or shale reserve development. According to a recent EIA report, increase in domestic production of 1.2 million bbl/d to 8.7 million bbl/d is the largest volume increase since recordkeeping began in 1900. This increase in U.S. shale and tight crude oil production has also resulted in a decrease of crude oil imports to the U.S. Gulf Coast area, particularly for light-sweet and light-sour crude oils. These trends are visualized in the EIA’s crude import tracking tool, which allows for time-series analysis of crude oil imported to the United States.

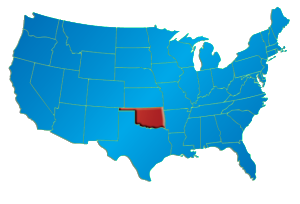

According to the EIA, in the United States, unproved technically recoverable resources of tight oil are estimated at 58 billion barrels. This estimate includes reserves from the Bakken/Three Forks, Eagle Ford, Woodford, Austin Chalk, Spraberry, Niobrara, Avalon/Bone Springs and Monterey plays. Industry experts expect crude oil production in the U.S. to trend upward peaking around 2020.

According to the U.S. Energy Information Administration production analysis, the United States remained the world’s largest producer of petroleum and natural gas hydrocarbons in 2018. The Drilling Productivity Report recently released by the EIA provides additional detail on domestic drilling activities. The report focuses on the most active seven regions of drilling activity.

Global Economy

According to the EIA Annual Energy Outlook 2015, world energy consumption is expected to grow to approximately 121m barrels per day by 2040 which is 3 percent higher than anticipated growth reported in the 2014 analysis. Most of the growth in energy consumption is occurring in developing countries. Fossil fuels are anticipated to continue to supply almost 80 percent of world energy use through 2040. Natural gas is the fastest-growing fossil fuel in the outlook. Global natural gas consumption is increasing year over year and that trend is expected to continue through 2040. Natural gas is a very desirable energy source when compared with other hydrocarbon fuels due to the fact that it is more environmentally friendly. According to the IEO(International Energy Outlook), “it is the fuel of choice for the electric power and industrial sectors in many of the world’s regions, in part because of its lower carbon intensity compared with coal and oil.” The reduced carbon footprint makes it an attractive fuel source in countries where governments are implementing policies to reduce greenhouse gas emissions. The 2015 outlook anticipates reductions in demand in the transportation sector due primarily to improved fuel efficiency. The industrial sector accounts for the greatest share of energy consumption and expected to continue to grow.

The industrial sector total delivered energy consumption is reviewed in the 2015 report in three reference cases and in each one, increases in use are expected through 2040. That sector is expected to continue as the largest consumer and projections estimate that the industrial sector will use over half of global delivered energy in 2040. Due to its environmentally friendly status and the significant increase in shale production in the U.S., natural gas is in a strong competitive position in relation to other energy sources in the market. The most current data shows that the United States and Russia each increase natural gas production, together accounting for nearly one-third of the total increase in world gas production. The world’s largest consumer of natural gas is the United States and it is also projected to have the region’s highest annual consumption growth increasing through 2040.